In an increasingly crowded marketplace, traditional banks are battling “challenger” banks over customer experience. In the UK alone, around one in 12 personal current accounts are now held with a digital challenger bank, up from just 1% in 2018.

What can banks do to differentiate their services, win customer loyalty, and, as a result, boost their revenue? Ultimately, it all comes down to data, and using it wisely to boost customer experience in an ever-evolving legal landscape. Carry on reading to find out how.

Summary :

The future of banking in an increasingly regulated digital ecosystem

PSD2. GDPR. These eight characters have had a big impact on the financial services sector. The second Payment Services Directive (PSD2) – known as Open Banking in the UK - became law across the EU in 2018, making it mandatory for European retail banks to release their customers’ financial data via APIs to trusted third-party service providers.

In common with the GDPR, implemented in the EU the same year, PSD2 is built around a core principle of protecting consumer data.

Customer consent is required before any information can be shared. And, without this consent, banks are unable to use customer data for analytics, retargeting, or monetization. They have little information on what their clients' specific needs are, and what potential commercial opportunities could be offered to address these.

Non-compliance can not only result in fines, but also in reputational risk, which could prove dire as, in an increasingly crowded marketplace, banks (both traditional and “challenger”) compete to offer optimized customer experience and boost loyalty.

Where once customers would have a bank for life, with whom they dealt with a designated trusted advisor, typically face-to-face in branch, they are now spoilt for choice. Over a quarter of Brits now switch banks every three to five years.

Banks must offer an optimized customer experience in order to boost customer loyalty. And, amongst other factors, customer loyalty comes down to data, how banks collect it, and how they use it to optimize the client experience.

The importance of data in optimizing customer experience

In the UK, 71% of consumers report being concerned about how their data is being used. However, two-thirds of banking customers are happy to provide more data to help trusted advisors meet their specific needs.

As such, banks must draw a delicate balance between collecting data to boost user experience, but doing so in a way that promotes trust. Digital interactions prioritizing transparency and personalization can help banks to grow, gain consumer trust and build strong and long-lasting customer relationships.

Put simply, if banks use customer data in a transparent manner to deliver truly personalized experiences, they stand to boost loyalty and attract new clients.

How can they do this? Here’s a walk through the typical consumer journey of a banking client, with an emphasis on transparent data collection throughout.

Step 1 - It all starts with the first website visit

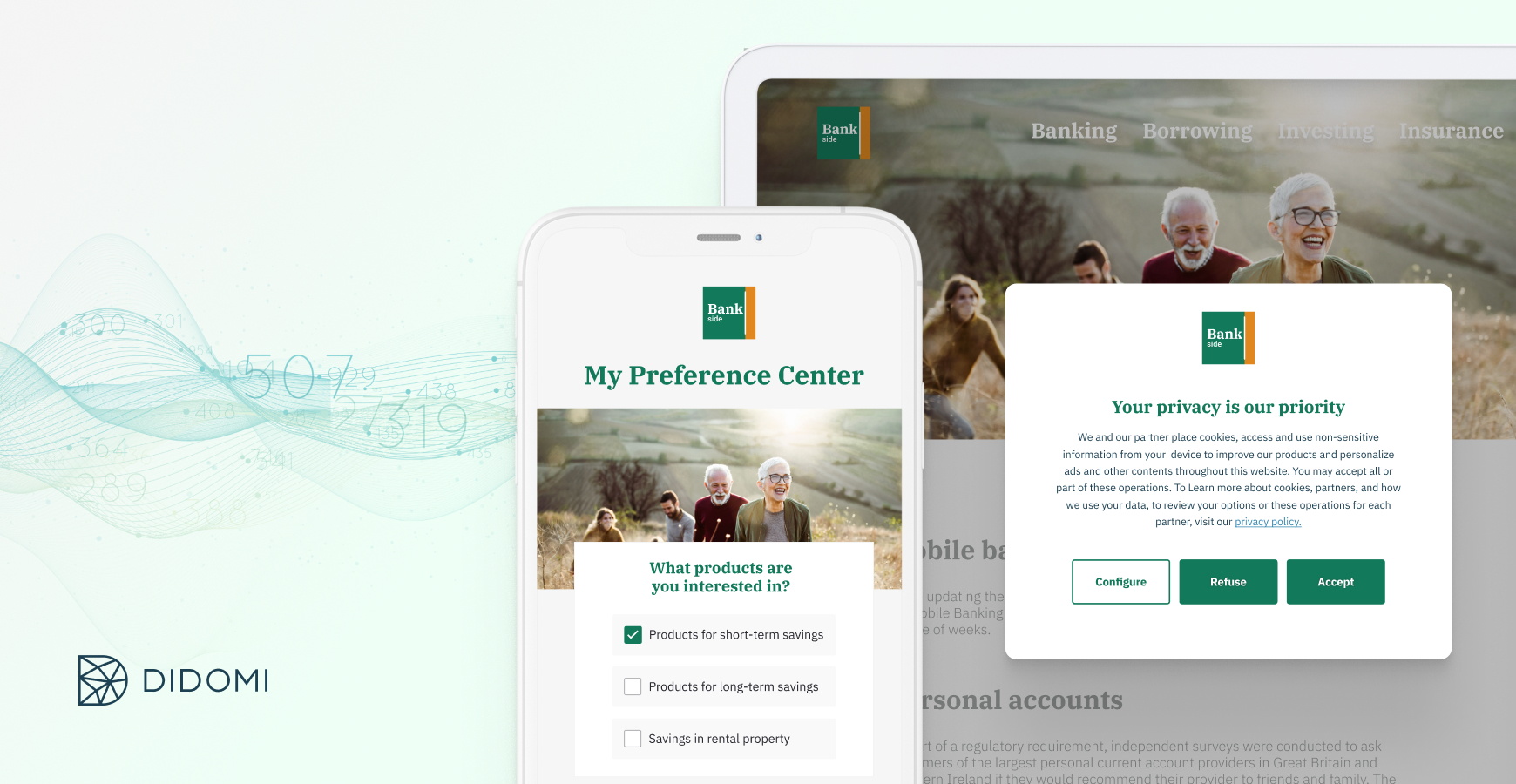

Here, the potential client will be asked to give cookie consent. This is the very first interaction they’ll have with the bank, and, as such, the chance to make a good first impression.

Not only can banks use a consent notice to ensure GDPR compliance, solutions such as the Didomi CMP also provide authenticated, dated proofs of consent, should a client or regulatory body ever wish to see them.

It’s important for banks to prioritize clarity and user experience when implementing their cookie notice. Some 80% of consumers believe that transparency is important for trusting a company, and this crucial first touchpoint sows the seeds for a client journey based on trust.

Step 2 - Becoming a client: managing consent across multiple touchpoints

Now that you have the customer’s attention, it is time to impress them. A customer who feels taken care of is more likely to stay. Once a prospect becomes a customer, their preferences and consents remain invaluable information for the bank.

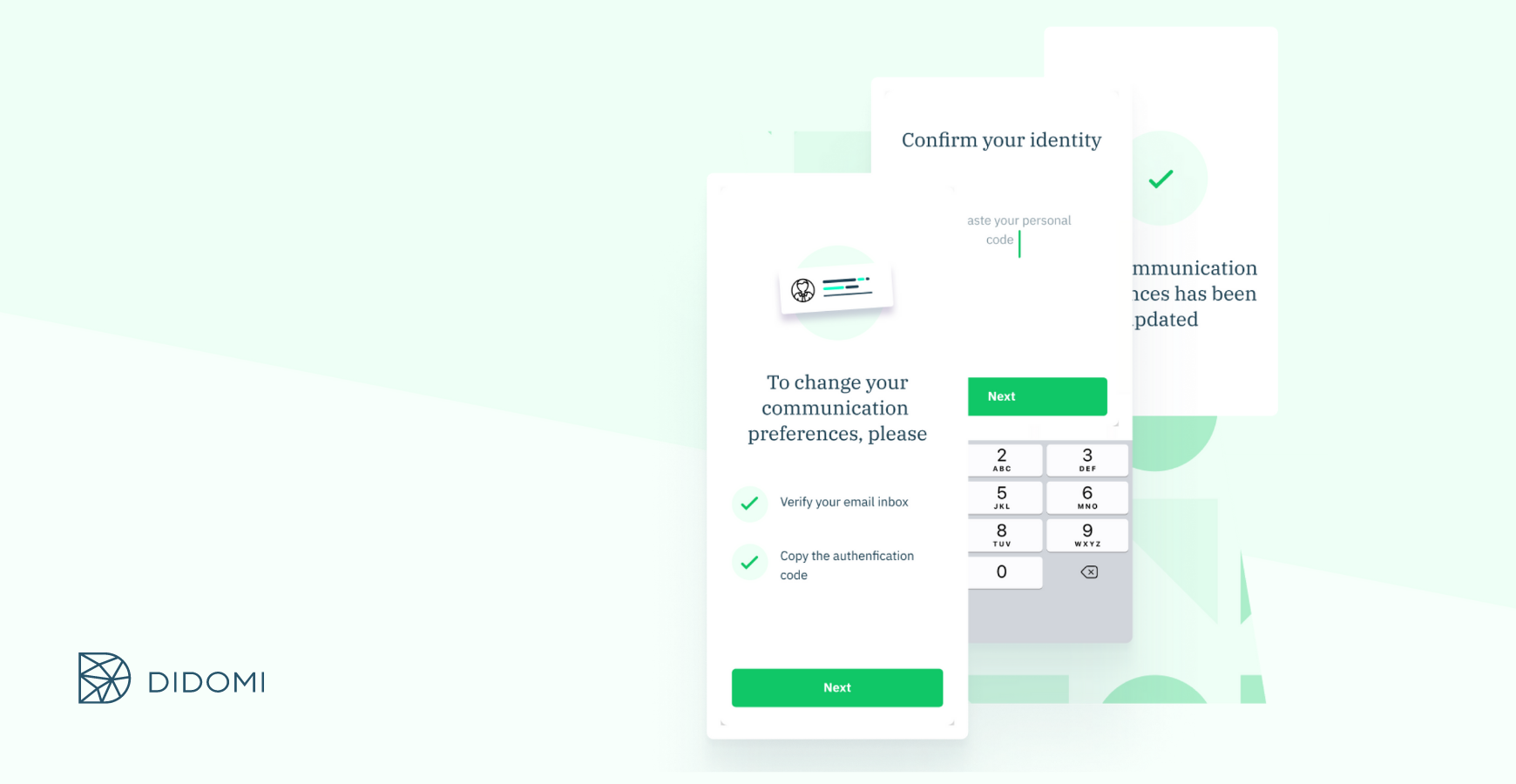

Consent will now need to be given across a range of touchpoints – on a bank’s website, on its mobile app, and in branch, during face-to-face meetings with a customer’s dedicated advisor. So it’s vital that, wherever consent is given, it’s synchronized to ensure preferences are up-to-date and consistent across the board.

Today, high-quality banking is an elaborate combination of direct physical, asynchronous and digital communication. To stand out from the competition, banks will need a consent architecture in place that covers all touchpoints.

Didomi’s technology enables banks to drive opt-in at every stage of the customer journey, maintaining an audit trail of customer consent, as well as knowing how to reach their customers, how often, and with the level of advice they expect.

Step 3 - Boosting customer loyalty through personalized services

The third step comes down to added value: banks collecting customer consent and data to receive personalized offers based on their financial situation.

People rely on their banks to support them during significant life moments – going to university, moving house, having a baby, or retiring. For banks to provide this support, however, they must build a relationship of trust with their client.

Every customer is unique, and so are their preferences when it comes to financial communication. Didomi’s bespoke consent and preference management solutions design consent workflows to ensure that this crucial preference data is collected transparently.

Nothing shows you care like an easy-to-use design and personalized communication: Didomi ensures that clients can manage their preferences and consents in the most user-friendly way possible.

With Didomi, banks can create a relationship of trust by putting consumers in the driving seat of how their personal data is used. They can then reach their customers on the right channel, at the right time, with the right offers and personalized content, increasing engagement and, ultimately, loyalty.

Boosting customer loyalty with a privacy-first approach

The exponential growth of online banking boosted by factors such as the Covid 19 pandemic has forced the UK’s biggest banks to shut down many of their branch offices — in 30 years, two-thirds of branches have been closed down.

Delivering exceptional customer experience and customer loyalty has been digitized. And providing personalized experiences online relies on data.

In a world of increasing data protection and growing consumer concern surrounding enterprise data policies, creating value with trust should be at the forefront of the banking sector’s client relationship strategy.

Digital interactions prioritizing transparency and personalization can help banks to grow, gain consumer trust and build strong and long-lasting customer relationships.

A transparent, performant data strategy can be the way for banks to get ahead of the competition and boost privacy-conscious revenue growth.

Didomi helps banks implement a full consent architecture that covers every step of the customer journey. With Didomi’s technology in place, customers will feel free and comfortable to give their consent and data, and banks can present their different services for beyond banking, ensuring compliance, while delivering the best possible customer experience.

.png?width=3600&name=WHITEPAPER%20-%20Banking%20%20-%20Socials%20(Rectangle).png)